Suburban Cobb County Sees Homes Increase in Taxable Value by 3.1%

O'Connor discusses how the suburban Cobb County residential property owners saw a 3.1% increase in taxable value.

ATLANTA, GA, UNITED STATES, June 13, 2025 /EINPresswire.com/ -- A major component of the Atlanta metropolitan area, Cobb County is in the heart of Georgia. One of the fastest-growing communities in America, Cobb County and the greater Atlanta area are quickly becoming one of the top property markets in the United States. However, while an economic boom and an increasing population are great for the area in the long run, growing pains can be expected. This includes increasing values for homes and business properties. Therefore, when the worth of property climbs, so do property taxes.Cobb County Residential Taxable Value Rises 3.1%

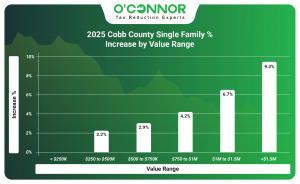

According to the Cobb County Board of Tax Assessors, the market value of all single-family residential properties is $103.50 billion. This is 3.1% higher than the 2024 total of $100.35 billion. Properties of all values saw their worth increase in this timeframe, with the exception of homes valued under $250,000. The majority of value was found in homes worth between $250,000 and $500,000 and those worth $500,000 to $750,000. They were valued at $46.43 billion and $31.17 billion, respectively. Homes of even higher worth saw their taxable value increase the fastest of all, with homes assessed at over $1.5 million rising by 9.3%.

Atlanta has a long history and reputation for being a city of the working and middle-classes, and this is represented strongly in how homes are valued. Homes that totaled less than 2,000 square feet, to those below 4,000 square feet combined for a value of $90.32 billion. These average-sized homes saw their value increase around 3%. Larger homes increased in value between 4.3% and 4.5%, depending on square footage. The largest growth rate was seen by luxury homes, which increased by 7.8%, making their total taxable value around $549.08 million.

When homes across Cobb County are categorized by their age of construction, the story of the area’s growth can be read, almost like the rings of a tree. Homes built between 1981 and 2000 contributed to 44% of all assessed value, while those built between 2001 and 2020 added 29% of it. This confirms Cobb County as a thriving and changing community over the previous few decades. New construction saw its assessed value go up by 5.3%, and it already totals 3% of all Cobb County value. Even the oldest properties in Cobb County saw a mild increase of 2.9%. Homes listed in the “other” category saw a skyrocketing jump of 821.3%.

Cobb County Homes Undervalued?

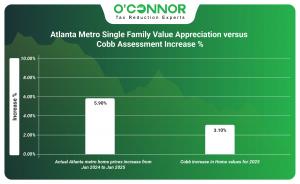

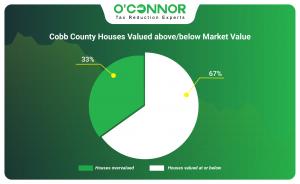

While Cobb County homes of all stripes are seeing their values increased by the Cobb County Board of Assessors, it may be lagging behind their actual value. This is certainly a boon for the homeowners of Cobb County, as most places in the nation that are seeing rapid growth instead experience inflated values that do not reflect sales. Of course, all are not so lucky, and it was estimated that 33% of homes were overvalued in 2025. This means that they were overtaxed compared to their worth. While not as horrendous as expected, one-third of homes being overvalued is solid grounds for concern and, of course, property tax appeals.

A study by an outside source also indicates that the Cobb County housing market may be underestimated by assessors. Georgia MLS Real Estate Services, an all-encompassing source for local relators, revealed that Cobb County homes were selling for 5.90% more than they were the previous year. This compares favorably to the 3.10% increase tabulated by the Cobb County Board of Assessors. As home sales are one of the many ways to establish the true worth of property, this could indicate that homeowners are actually paying less in taxes than they should.

Cobb County Commercial Property Notches 0.7% Increase

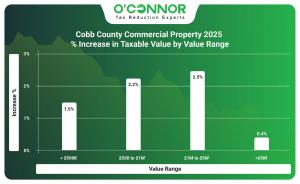

While homes are seeing a steady rise in their taxable value, commercial properties are edging upwards at a slower pace. Valued at a combined $26.13 billion, combined commercial property grew by 0.7% in 2025. $21.61 billion of all value was attributed to businesses worth over $5 million. As Atlanta and the surrounding area are home to countless major businesses, this number is not surprising. Despite their size, these major companies only saw their taxable value go up by 0.4%. The largest value increase was experienced by commercial properties worth between $1 million and $5 million, with 2.5%.

When broken down by type, it is clear to see that the biggest chunk of value is reserved for apartments. This is typical for suburban areas across the country, with the total of $12.55 billion being about average. Despite their large lead, the value of apartments shrunk by 1.4% in 2025. Offices and retail businesses, the second and third place business types, also saw small losses. Raw land saw the biggest jump in value, adding 57.1% in taxable value, while also being the lowest in total value. Hotels scored a respectable gain of 11.6%.

Like residential property mentioned above, Cobb County’s commercial value is centered on construction between 1981 and 2020. Businesses built between 1981 and 2020 accounted for 35% of all assessed value, while those built from 2001 to 2020 made up 21% of the total. Both of these date ranges saw a drop in their value of over 2%. While only a fraction of the total, businesses built before 1960 saw a jump of 17.1%. New construction was not recorded but could be folded into the “other” category, along with land.

In a break from the trends established by residential property, it is possible that Cobb County commercial property is overvalued. According to the legendary property analytics firm Green Street, the real value of commercial properties across the United States shrank by 15%. This puts their numbers in opposition to the Cobb County Board of Assessors’ 0.7% growth rate. This is mainly due to economic conditions, like higher interest rates, trouble borrowing, and investments going places other than real estate. It should be noted that Green Street’s figures are targeted at the nation as a whole, not just Georgia, so this leaves room for different possibilities.

Apartments Lose Value but Remain No. 1

Apartments remain the top commercial property in Cobb County by a wide margin, but they did see their taxable value fall by a combined 1.4% in 2025. This total loss was caused by significant drops in major reservoirs of value, that being apartments constructed between 1981 and 2000. These make up 39% of all apartment value and experienced a drop of 6.2%. This was followed by a drop of 3.6% for apartments built between 1961 and 1980, the second-largest block. While not labeled as such, it appears new construction moved to fill the gap, as “other” apartments saw a growth of 23.3% to make up 10% of all value.

Cobb County apartments are only broken down into two subtypes, so this lessens our ability to understand market changes. Still, the obvious trend is that high-rise apartments saw a strong gain of 9.2%, while low-rise apartments saw a loss of 5.3%. Low-rise apartments still account for $8.83 billion in value, compared to $3.72 billion for high-rises. This trend is typical for growing suburban counties, as more advanced apartment types are built to meet increasing demand.

Offices Contract by 0.6%

Cobb County has seen a significant investment in new construction for office buildings in recent years, with many advanced high-rises being added to the skyline. Though mixed with older construction on the graph as “other,” it can clearly be seen that new construction is vital to Cobb County’s future. Like both residential and other commercial properties, a large part of the construction value is reserved for buildings that were built between 1981 and 2020.

The Cobb County Board of Assessors divides offices into three subtypes. High-rises are the top office type currently, with $2.50 billion in value, while low-rise offices came in second with $1.64 billion. High-rise offices saw their assessed value drop by 1.9%, which is what pulled the average down. Low-rise offices rose slightly by 0.3%, while medical offices were able to grow by 1.7% in value.

Retail Shrinks 1%

Offices were hit hard by the pandemic, while shifts in shopping habits have done damage to retail spaces. The taxable value of retail properties dropped by 1% as a whole in 2025, but there was growth in other places when it is all broken down by age of construction. The largest loss in assessed value came from retail spaces built between 1961 and 1980, with a total of 3.1%. While a reduction of 1.3% for buildings constructed between 1981 and 2000 was lower by percentage, it accounted for a greater loss due to the size of the value pool. New construction and the old properties both saw increases of 3.2% and 2.2% respectively.

When broken into subtypes, it is easier to see where the value drops originated from. Neighborhood shopping centers were the No. 1 retail subtype in 2024 but dropped to No. 2 after losing 4.3% of their value. They were replaced by community shopping centers, which grew 1.3% to $847.36 million. Malls lost 3.1% in taxable value but only accounted for $213.05 million of the total. Strip shopping centers showed a tiny drop of 0.2%.

Warehouses Keep Value

Warehouses are important no matter what the economic situation is and this is kept true in Cobb County. Warehouses managed to grow by a combined 1.8%, while showing no losses in any construction timeframe. The pattern of value established when properties are broken down by age continued as well, with most value being for buildings constructed between 1981 and 2000 or those from 2001 to 2020. While these accounted for 43% and 31% of the total respectively, new construction also managed to grow by 2.7%, representing 9% of total warehouse value.

Warehouses are featured as three different subtypes to help understand how value is attributed. Metallic warehouses grew by 5.8% in 2025, accounting for a value of $1.2 billion. Standard warehouses managed to stay ahead of metallic ones with $1.35 billion in value, though they experienced a loss of 1.2%. Mini warehouses were not far behind with a growth of 1.2% and a total of $807.79 million.

The Big Picture of Cobb County

When the data is all crunched together, it appears that Cobb County is the standard suburban area around a major city, albeit one that is quickly on the rise. While suburban living is changing across the United States, Cobb County is still in a growth phase, one that is showing no signs of slowing down. Thankfully, it appears to be stable and not an unsustainable boom that leads to an even bigger bust. The fact that residential property may be valued and taxed less than its actual worth is a rarity with trendy suburbs.

There is still ample opportunity for property tax appeals; however, as 33% of Cobb County could be overvalued. As gentrification is a huge factor in the Atlanta area, that is also grounds for possible appeals. Commercial owners may need to be the most on guard, as they could still be overtaxed, even if assessed values edge down a bit.

Georgia has an arcane tax structure, with many rules not found in the rest of the United States. This can lead to misunderstandings and leaves Georgians in an awkward position where they do not know how best to combat rising taxes. One valuable aspect to tax protestors is the property tax freeze. This means that if an appeal is successful, then the assessed value will remain at that amount for three years. This can produce significant savings over time. Join O’Connor today and get your best chance at an appeal victory and a tax freeze. With over 50 years in the business, O’Connor knows how to take on the Cobb County Board of

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Georgia, Texas, Illinois, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.